5 Steps to Saving for BIG Purchases in Your Business

- Apr 24, 2024

- 6 min read

One minute you were feeling like an all-star business owner, and the next — you’re looking around wondering where that money’s gonna come from. Maybe you’ve gotten the hang of planning for your monthly business expenses i.e. Your internet bill, monthly subscriptions, and software all have a place in your budget. And each month, you pay the bills on time. You’re feeling good! You’re a business owner, and you’re taking care of business.

Then suddenly, another expense shows up. The yearly fee for your website. The cost to renew your Company or your computer finally breaks down after years of reliable service.

Unlike your fixed monthly costs, these expenses don’t have a spot in your budget. They don’t have a pile of money with their name on it, waiting to be spent.

I’m here to tell you it doesn’t have to be like this. You can plan for these “unexpected big expenses” — the ones that don’t come around every month.

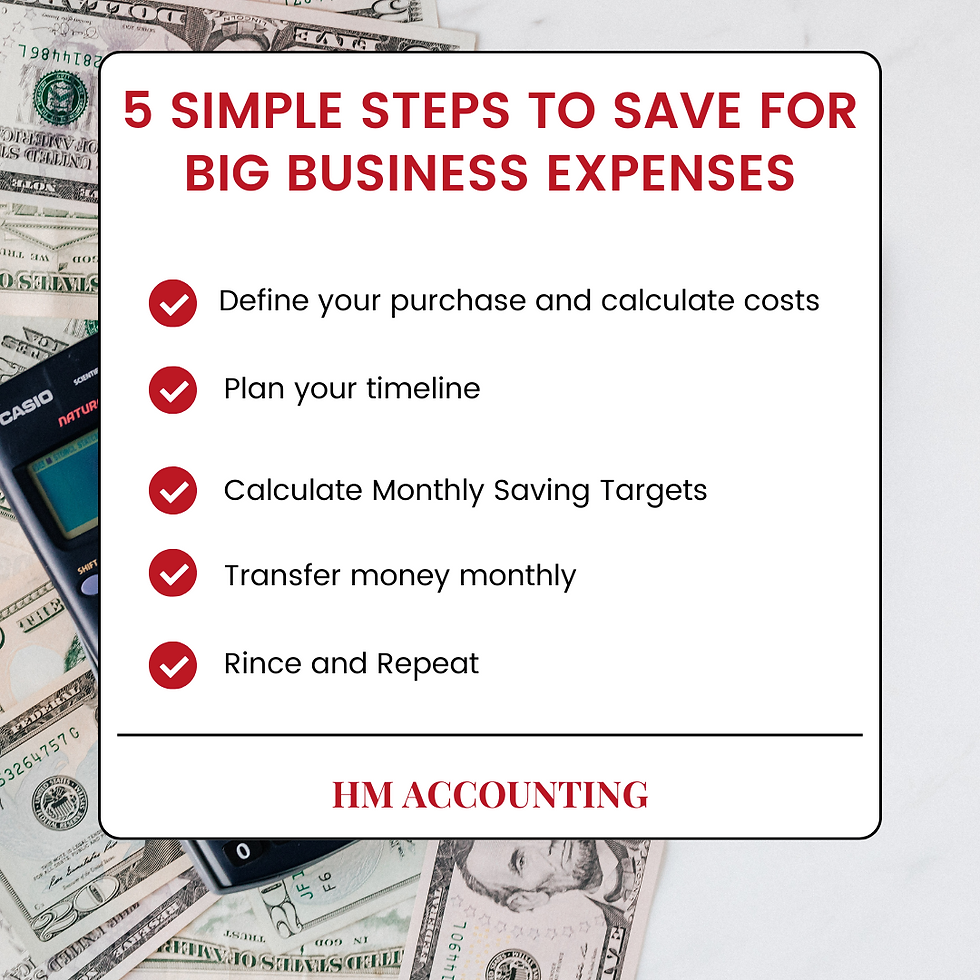

In this blog post, you will learn the 5 simple steps to saving for these unexpected, big business purchases.

Understanding True Expenses:

Saving for big purchases begins with understanding your true expenses.

When I say “true expenses,” I’m referring to those big, infrequent expenses that tend to sneak up on you. You don’t pay them every month, so they tend to slip through the cracks.

What expenses snuck up on you recently? What do you pay for every six months, every year, every few years?

Some true expenses are easier to nail down. They come around at the same time every year. Other expenses aren’t on a particular schedule. You know you’ll have to replace your computer at some point, but you don’t know exactly when.

Here are a few more examples of true expenses you may have in your business:

New equipment or technology

Annual subscriptions/renewals

Membership dues

Education, courses, or coaching

And of course, you can’t forget about your quarterly/provisional and annual tax dues, although these aren’t considered an “expense” for your business.

Enter Sinking Funds:

A sinking fund is a fund where you set aside money — ideally each month — to build up reserves for a specific purpose.

It’s important to note the difference between a sinking fund and an emergency fund. Sinking funds are for your true expenses — ones you can plan for, even if they’re irregular. You know you’ll need a new computer at some point. You know you’ll need to pay taxes each quarter.

On the other hand, an emergency fund is for unplanned expenses or emergencies. Having sinking funds is no replacement for an emergency fund because they serve two different purposes.

A sinking fund is a tool to help you avoid dipping into your emergency fund or to help you avoid charging your credit card. By transferring money into your sinking funds each month, you’ll gradually build up the cash reserves you’ll need to pay for those big expenses.

Download your free guide to get started! - Download here

This guide includes regular tasks to build into your workflow to ensure you don't run out of cash, tips on how to create and keep a budget, and the best apps to use to track expenses seamlessly. With this guide, you'll feel confident in managing your cash flow and might even be checking your bank balance daily!

How to Save for Big Purchases

Now that you understand true expenses and sinking funds, let’s break down how to save for big purchases.

1. DEFINE YOUR PURCHASE AND CALCULATE COSTS

When you’re making a plan to save for a big purchase, start by prioritizing and defining your goals. You may have several big purchases on the horizon but start with the most important one. Write it down and commit to it.

Next, calculate the cost. You may not know the exact cost — that’s okay. Do some research and make your best estimate.

2. PLAN YOUR TIMELINE

Next, figure out how soon you want or need to make this big purchase.

Some purchases come with a deadline. For example, you can’t pay your membership fees whenever you want. If you missed a payment, you’d probably get kicked out. Deadlines like these make your timeline straightforward. It’s as simple as noting the given deadline in your savings plan.

If, on the other hand, your purchase isn’t tied to any date, it’s up to you to come up with a timeline. Think about when you need to make this purchase. Do you urgently need to replace your computer, or will it last another year? Can you wait six months to invest in coaching, or are you desperate to sign up next month?

For more flexible purchases, take into account how fast you think you’ll be able to save and create a reasonable deadline with this in mind.

3. CALCULATE MONTHLY SAVINGS TARGETS

Now for some (very simple) math!

Divide the total cost of your big purchase by the number of months there are before your deadline. This will tell you the amount you need to put in your sinking fund each month to reach your savings goal before your deadline.

Here’s an example:

Say you know you’ll need a new computer in the near future. You think you have at least six months with your current one before you need to replace it. You do some research and decide that the computer you want costs about R1,000.

Your goal is to put R1,000 in a sinking fund over the next six months. So you divide R1,000 by 6.

R1,000 ÷ 6 = R166.67

So, you need to save about R167 each month to buy the new computer in 6 months.

4. TRANSFER MONEY EACH MONTH

Once it becomes a habit, saving a little each month is much easier than trying to scrape up a large amount when you need it. The key is to make it a habit — or even better, make it automatic.

I’m a fan of using multiple accounts for different funds. Doing so means you don’t need to keep up a meticulous budget — instead, you know exactly how much money you have for each account’s purpose.

I recommend opening a new account for your sinking fund. That way, you won’t be tempted to spend the money on something else.

Set a date on your calendar each month when you’ll deposit the money. If you can, automate the deposit from your primary account. Set up a recurring monthly transfer for your monthly savings goal so you only have to think about it once. With one simple automation, you’ll wake up on your deadline with a fully funded sinking fund.

5. RINSE AND REPEAT WITH THE REST OF YOUR TRUE EXPENSES

Don’t forget to go through this process with the rest of your true expenses. It may seem complicated when you start to save for multiple purchases on multiple different timelines, but if you replicate this process, I promise it will be manageable. Once you get the hang of planning and saving for your true expenses, you’ll feel ready for everything that’s coming your way.

It's time to learn how to manage your cash flow like a pro!

Download your free guide to get started! - Download here

This guide includes regular tasks to build into your workflow to ensure you don't run out of cash, tips on how to create and keep a budget, and the best apps to use to track expenses seamlessly. With this guide, you'll feel confident in managing your cash flow and might even be checking your bank balance daily!

Need More Help Saving for Big Expenses?

At HM Accounting, I help business owners get confident about their finances, and there’s no better time to do than right now.

Big purchases don’t have to come as a surprise, depleting your hard-earned emergency fund. Even though running a business is full of ups and downs, your finances don’t have to follow suit. If you’re feeling overwhelmed trying to figure out how to save for big purchases in your business, you can always ask for help.

To see how we can help you and your business, email me at info@hmaccounting.online or simply schedule a free 30-minute Discovery Call on my calender.

The Ultimate and Complete Bundle for Small Business Owners

This bundle is the ULTIMATE solution for small business owners, entrepreneurs and start ups. Ive compiled these documents from my experience working with my clients and their needs. Get it here

This bundle has FOUR PDF downloads.

Includes :

1. Tax Prep checklist for small business owners

2. Business Finance Checklist which consists of the following essential checklists for all small business owners:

- 5 Tips to make expense tracking simple and effective

- Manage your money like a CEO (For business owners)

- Business Review (Key Financial and Non-Financial Indicators to look at during your business review)

- Areas to check during monthly business finance review

- Strategies to increase cash flow in your business FAST!

3. Business Growth Strategies

4. Cash Flow Management Strategies

Love staying updated on the latest trends, insights, and exclusive content? Don't miss a beat – subscribe to our newsletter today!

By subscribing, you'll be the first to know about:

✨ Exciting new blog posts

🚀 Special promotions and offers

🌐 Industry insights and trends

🎁 Exclusive content just for our subscribers

Join our growing community and never miss a moment - subscribe here

Great article!

if you are interested in turn your $150 into $5300 in just 2hours just click this link and add me up on WhatsApp +15017799388 or just click my WhatsApp link 👇👇https://wa.me/message/RQLLVKXDV7AWM1

I love it

I invited you NV9AHX